Introduction

Purchasing a new build house is an exciting endeavor, but it also comes with its fair share of challenges, especially when it comes to financing. Securing a mortgage for a new build property can be a bit different from the conventional home-buying process. In this comprehensive guide, we will explore the ins and outs of obtaining a new build house mortgage, providing you with valuable insights to make your dream of owning a brand-new home a reality.

Understanding New Build Properties

What Are New Build Houses?

Before we delve into the intricacies of financing a new build house, it’s essential to understand what exactly a new build property is. A new build house refers to a property that has recently been constructed or is under construction and has not been previously occupied. These homes often offer modern designs, the latest amenities, and energy-efficient features.

Advantages of Buying a New Build House

Investing in a new build house comes with several benefits. Some of the advantages include:

Customization options: Many developers allow buyers to personalize certain aspects of the house during the construction phase.

Energy efficiency:

New build properties are constructed with the latest energy-efficient materials and technologies,resulting in potential cost savings on utilities.

Low maintenance:

As everything is brand new, new build houses usually require minimal maintenance in the initial years.Warranty protection: New build homes typically come with warranties that cover structural issues and certain fixtures for a specified period.

Things to Consider Before Buying a New Build House

While new build houses offer numerous advantages, there are some considerations potential buyers should keep in mind:

Location

The location of the new build house is crucial. Research the neighborhood, proximity to schools, shopping centers, and other amenities that matter to you.

Developer Reputation

Choose a reputable developer with a track record of delivering high-quality projects on time. Look for reviews and testimonials from previous buyers.

Completion Timeline

Understand the estimated completion timeline of the new build property. Delays may occur, so be prepared for possible changes in moving-in dates.

Hidden Costs

Be aware of any hidden costs beyond the purchase price, such as maintenance fees, community fees, or property taxes.

Preparing for a New Build House Mortgage

Assess Your Financial Situation

Before applying for a build house mortgages, take a close look at your financial standing. Evaluate your credit score, existing debts, and monthly income to determine how much you can afford to borrow and repay comfortably.

Save for a Down Payment

Most lenders require a down payment for new build properties. Aim to save at least 20% of the property’s value to secure a favorable mortgage rate and reduce your monthly mortgage payments.

Get Pre-approved for a Mortgage

Obtaining a mortgage pre-approval will give you a clear idea of how much you can borrow and streamline the buying process once you find the perfect new build house.

Consider Mortgage Affordability

Take a conservative approach when determining mortgage affordability. Factor in possible changes in interest rates and unexpected expenses that may arise after moving into your new home.

Finding the Right Mortgage for Your New Build House

Research Mortgage Options

When financing a new build property, explore different mortgage options available to you. Consider fixed-rate mortgages, adjustable-rate mortgages, and government-backed loan programs.

Shop for Lenders

Don’t settle for the first lender you come across. Shop around and compare mortgage rates, terms, and closing costs to find the best fit for your financial situation.

Understand Mortgage Terms and Conditions

Thoroughly read and comprehend the terms and conditions of the mortgage before signing any agreements. Seek clarification from your lender if you have any doubts or concerns.

Seek Professional Advice

If you’re unsure about the mortgage options available or need assistance with the application process, don’t hesitate to seek advice from a qualified mortgage broker or financial advisor.

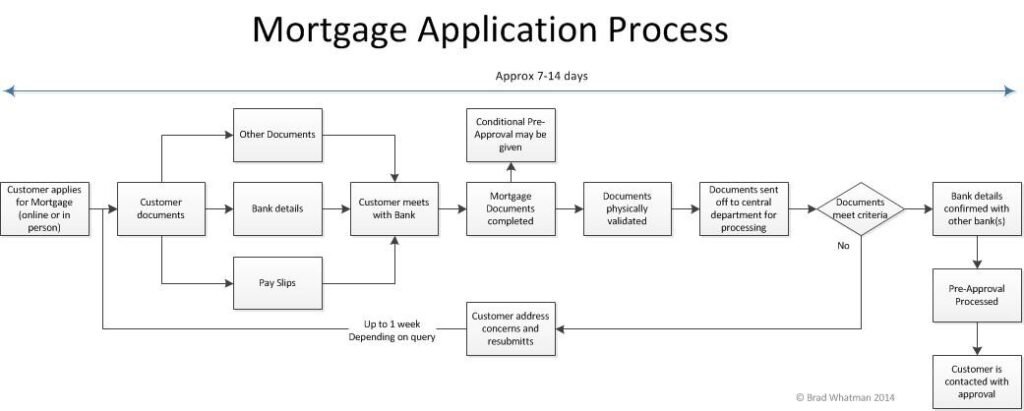

The Mortgage Application Process

Gather Necessary Documents

Prepare all the required documents for the mortgage application, including income verification, tax returns, bank statements, and identification.

Submit Your Application

Submit your mortgage application along with the supporting documents to the chosen lender. Be patient during this process as it may take some time to get approval.

Appraisal and Inspection

The lender will arrange for an appraisal and inspection of the new build property to determine its value and ensure it meets safety standards.

Loan Processing

During the loan processing phase, the lender will verify the information provided in your application and conduct a credit check.

Conditional Approval

Upon successful completion of the loan processing, you will receive conditional approval for the mortgage.

Closing the Deal

Review the Closing Disclosure

Before the closing date, carefully review the Closing Disclosure, which outlines the final terms and costs of the mortgage.

Attend the Closing Meeting

On the closing day, meet with the seller, your real estate agent, and the lender to sign the necessary paperwork and complete the purchase.

Celebrate Your New Home

Congratulations! You are now a proud owner of a new build house. Celebrate and enjoy your new home with your loved ones.

Conclusion

Investing in a new build house is an excellent choice for those seeking a modern, energy-efficient, and low-maintenance property. By following the steps outlined in this guide, you can secure the right mortgage for your dream home and make the home-buying process smoother and more rewarding.